When it comes to financing the business, several options are available to minority-owned businesses. One option is to seek out loans specifically designed for minority-owned businesses. These types of loans can be extremely beneficial, as they can help to level the playing field and provide much-needed access to capital. The Small Business Administration (SBA) is one of the most well-known sources of financing for these types of businesses. Another option for minority-owned companies is to seek out community development financial institutions (CDFIs). Minority-owned business loans can be an extremely helpful tool for business owners who may otherwise have difficulty accessing traditional forms of financing. These loans can help business owners start or expand their businesses, create jobs, and contribute to the growth of underserved communities. Do you want to know the types of Loans For Minority-Owned Companies?

What are Minority-Owned Businesses?

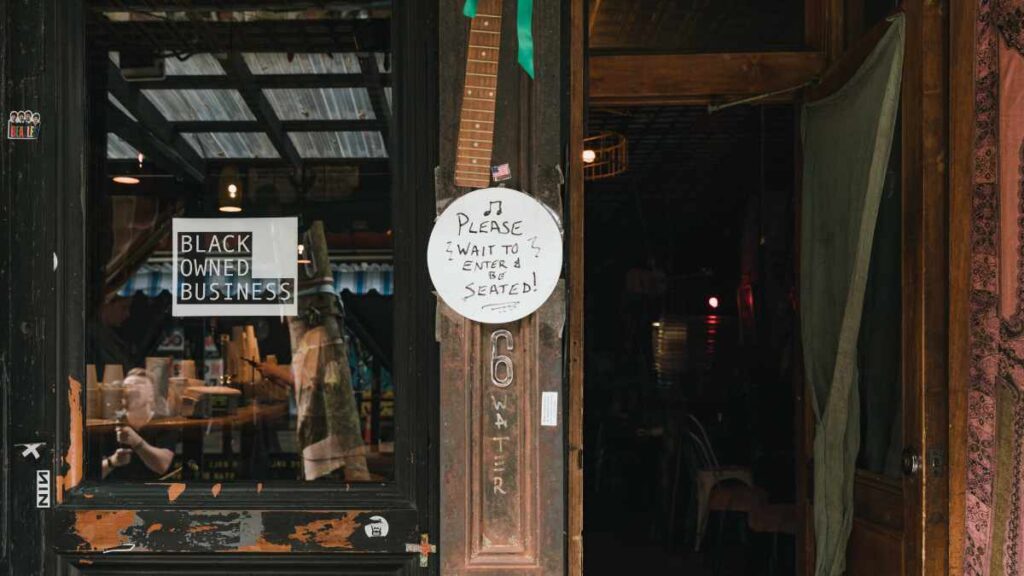

When you talk about minority-owned enterprises, we refer to businesses owned and operated by members of a minority group. These could be businesses run by women, ethnic minorities, or disabled people. Minority-owned enterprises often face difficulties when it comes to securing funding and loans. This is because lenders often see them as high-risk due to the inherent discrimination that exists in society. However, several programs and initiatives aim to help minority-owned enterprises secure the funding they need to grow and thrive.

If you are a member of a minority group and are thinking about starting your own business, then be sure to research the various loan options available. Your minority-owned business can achieve great things with the right support and financing!

Best Short-Term Loans for Minority-Owned Businesses

The best option for your business will depend on several factors, including the size of the loan you need and the terms you are looking for. There are several loans for minority-owned businesses which are as follows:

SBA Microloans For Minority-Owned Businesses

One option for short-term loans for minority-owned businesses is SBA Microloans. TheSmall Business Administrationprovides these loans with a $50,000 maximum value. These loans may be utilised for working capital, stock, or equipment, among other things. The terms of these loans vary depending on the lender, but they typically have repayment periods of six to twelve months.

Merchant Cash Advances For Minority-Owned Firms

Another option for short-term loans for minority-owned firms is merchant cash advances. With this type of loan, you receive a lump sum of cash upfront and then repay it through a percentage of your future credit card sales. This can be a good option if you have consistent sales and can repay the loan quickly. However, it is important to note that merchant cash advances often have high fees and interest rates.

Loans from Friends and Family For Minority-Owned Enterprises

Finally, you may also be able to get a short-term loan from friends or family members for minority-owned businesses. If you have someone willing to lend you money, this can be a good option since there is no interest to pay back. However, it is important to make sure that you put something in writing so that there is no misunderstanding about the loan terms.

Best Medium-term or Long-term Loans for Minority-Owned Companies

Not all loans are created equal. Some loans have better terms and conditions than others, making them more suitable for certain businesses. To help you find the best medium-term and long-term loans for your minority-owned company, here is a compiled list of some of the best options available:

SBA 7(a) Loans Program For Minority-Owned Enterprises

This program offers loans of up to $5 million for businesses that cannot secure financing from traditional lenders. The terms and conditions of these loans are very favourable, making them a great option for businesses that need medium-term financing.

SBA 504 Loans Program For Minority-Owned Companies

This program provides long-term, fixed-rate financing for major capital investments, such as real estate or equipment purchases. Loans can be up to $20 million and have attractive interest rates.

Minority Enterprise Small Business Investment Companies (MESBICs):

These are private equity firms that provide funding and mentorship to minority-owned businesses. MESBICs typically invest in companies with high growth potential located in underserved markets.

Community Development Financial Institutions (CDFIs):

These are mission-driven lenders that provide financing to businesses in underserved markets. Microloans are one of the several loan options offered by CDFIs.

Union Bank Business Diversity Lending Program

Union Bank is another great option to consider if you’re looking for minority-specific business funding. Only minority-owned enterprises are eligible for the business loans and lines of credit they offer. These products are preferred by minority small business owners seeking a loan of up to $2.5 million since they have less stringent lending criteria than conventional Union Bank small-business loans. Loan solutions are available with maturities of up to 25 years and fixed or floating interest rates.

Business Development Program Under SBA 8(a)

Your company should be 51% held by someone from an economically and socially marginalised background to qualify for this program. According to federal legislation, minorities are socially disadvantaged. The owner must have $4 million in assets, a net worth of no more than $250,000, and an average annual gross income of no more than $250,000.

Online Business loans available for minorities owned businesses are Ondeck, BlueVine, and Foundation.

Tips for Comparing Loans for Minorities-Owned Businesses

There are a few things to keep in mind when trying to compare loans for minority-owned businesses. The first is the type of loan you are looking for. Different types of loans are available, each with its interest rates and terms. Make sure you know what you need before shopping around. The second thing to consider is the interest rate. This will vary depending on the lender, so comparing rates from multiple sources is important. Third, remember to factor in any fees or closing costs associated with the loan. These can add up quickly, so be sure to ask about them upfront. Finally, don’t forget to shop around! There are a lot of options out there, so take your time and find the best deal for your needs. With a little research, you should be able to find a great loan that fits your budget and helps you grow your business.

Other Loan Options For Minority-Owned Enterprises

There are a few other financing options available to minority-owned enterprises. These include:

Grants For Minority-Owned Businesses

Many organisations offer grants to minority-owned businesses. A quick Google search will help you find some of these organisations.

Crowdfunding For Minority-Owned Companies

This is a newer option, but there are now platforms specifically for crowdfunding minority-owned companies. Again, a quick online search will help you find these platforms.

Personal Savings Of Minority-Owned Enterprises

If you have some personal savings, you could use this to start or grow your business. This is a riskier option than taking out a loan, but it can be worth it if your business is successful.

Conclusion

When it comes to getting capital and loans for minority-owned businesses they sometimes struggle. Due to the ingrained discrimination present in society, lenders frequently view them as high-risk borrowers. However, there are several efforts and programs in place that are intended to assist minority-owned companies in obtaining the finance they require to expand and prosper. In conclusion, the best advice for minority-owned enterprises when it comes to types of loans is to be aware of the many options available like Small Business Administration programs – 7(a), 504, 8 (a), Microloans, etc. and to consult with a financial advisor to determine which option(s) make the most sense for your business. Be sure to also read the fine print and understand the terms and conditions of each loan before signing on the dotted line.

For more insights and ideas related to businesses, marketing, social media, financial awareness, business essentials and technology check out BiznessHub, to explore further opportunities and knowledge.

FAQs

Ques. What are Loans For Minority-Owned Businesses?

Ans. These are loans made for minority business owners.

Ques. Does the government provide Loans For Minority-Owned Enterprises?

Ans. Yes, there are several policies provided by the government.

Ques. Do banks provide Loans For Minority-Owned Companies?

Ans. Yes, they do provide it, you can check through the site of the bank.