Deciding how to invest your money in your 20s may seem overwhelming at first, and it might be hard to understand where to start. But the pro tip here is that one doesn’t need to have a lot of money upfront to invest in your 20s. The most important thing is to start investing early, which you can do investing in your 20s.

The phase of being in your 20s is the most carefree one. You might not believe it in the starting, but it is true. You don’t have to take care of your spouse, you don’t have to fill the mortgage, or you don’t have the responsibility of your kids. These are the things that take lots of money from any human being.

Thinking about how to invest in your 20s means you are about to graduate, which means you have basic knowledge about how this world works and the possible good areas for investment. If you don’t have any idea, then you are not alone. Multiple times there are chances that you don’t know the possible areas for investment. You need not think a lot as this article is for you; in this article, you will find all the answers to your questions.

However, beginning the investing process can be a daunting task for new investors, considering the wide range of options available in current times and the various strategies to choose from.

Let us first understand the areas where you can invest in your 20s.

How Should You Invest in Your 20s?

Start Investing Early in Your 20s

Delaying investing is the most common money mistake made by individuals in their 20s. The main reason behind this is the belief that there is sufficient time to reach financial goals, so 5 to 10 years won’t make a significant difference.

You must have heard about the phrase ‘Many a little makes a mickle.’ If you are not aware of this, then let me brief you about it. It means that every effort, in the end, brings great results.

A similar thing goes for this. If you start investing early in your 20s, then you will have larger savings rather than those limited. This can count as an extra saving as it is unplanned and also can help you in future studies if you want to do. Investing makes you self-independent, which is beneficial for everyone.

Determine Financial Goals to Invest Your Money in Your 20s

It may look tough to achieve specific goals as they are way too out of the league for you, but you can complete them if you can break them into pieces. For this, you need to determine the financial goals that you have to invest your money in your 20s, and if you are confused about your financial goals, then this will help you. You need to gather your thoughts together about your dreams and aspirations, which you want to achieve in your life.

While determining the purpose of investing, break your financial goals into the break down short, medium, and long-term targets. For example, the money you save for a medium-term goal, like a down payment for your car, should be treated differently than the retirement savings you won’t need for 50 or more years. So, analyze and earmark your savings for a specific financial goal.

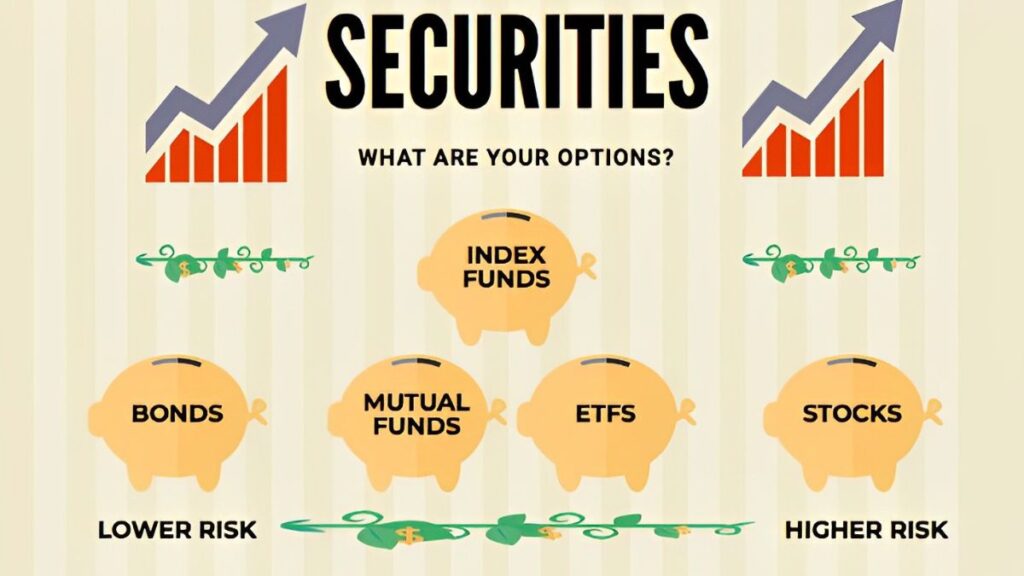

Decide Where to Invest Your Money in Your 20s

This is crucial to think where to invest your money in your 20s.Think about your immediate, short term and long-term financial needs before investing your money in your 20s, and then consider the various options:

Where to Put Immediate Money To Invest in Your 20s?

Food, bills, rent, and everything else you must pay for on a month-to-month basis are immediate needs. Often such money is kept along with a cushion in an online bank account so that it is not over-drafted.

Such accounts allow you to withdraw money instantly, without penalties, making them the ideal choice for your immediate financial needs.

Where to Put Short-term Money To Invest In Your 20s?

Short-term money might be needed in the next couple of years, such as a travel fund, wedding fund, or home down payment savings.

High-yield savings accounts, in addition to other cash equivalents like certificates of deposits (CDs) and money market accounts, are considered to be lower-risk investments and hence a better option for investors as they provide a better return on your money than traditional savings accounts.

Diversify & Take Risks To Invest Your Money in Your 20s

Diversifying investments and taking risks in the twenties can pay off handsomely. Therefore, don’t limit yourself to just a single form of investment. Never risk your entire funds on a single endeavor.

Rather, strive to diversify your revenue sources and hedge your risks by seeking fresh investment opportunities. This shields you against catastrophic losses and enhances your chances of profitability. Take chances while you are young. Invest in stocks with a higher risk-to-reward ratio.

Take Out Some Money for an Emergency

Sometimes you never know where you land, you might be doing well, but some emergency comes from nowhere. Especially if you live in PG, in a hostel, or far from your family, then you must save some money for your future and emergencies if they happen.This is a great strategy to start investing in your 20s. If you live alone with your family, then the investment is something that can help you with your future expenses. You can invest in some policies which give great returns with interest in the coming 4-5 years.

These policies vary depending on your capacity to invest, some policies ask you to invest a few thousand each month, and you get an interest of 12-13% during the financial year-end.

Conclusion

The twenties are said to be the decade of having fun and exploring the world. However, this is not completely true. You should work on your monetary plans. Where do you want to go in the coming decades? How can you get financially independent with this plan? What should be the right strategy for being independent at a young age? Exposure comes with being determined toward your future.

The best answer about the right time to start investing in your 20s is – right now. By starting investments early in life, one gains a key advantage – time. People who begin investing in their 20s have more time to grow their wealth. Therefore, they are in a better position to achieve their financial goals easily.

For more insights and ideas related to businesses, marketing, social media, financial awareness, business essentials and technology check out BiznessHub, to explore further opportunities and knowledge.

FAQs

Ques. Can anyone be financially independent at the age of 20?

Ans. Yes, you can be financially independent through your internships or businesses,

Ques. Can you invest with a low income?

Ans. Yes, you can, but the investment will be small.

Ques. Can investment made in the early 20s bring bigger returns in the future?

Ans. Yes, no doubt about it. You can invest in mutual funds, government policies, share markets, and many more.